Superstore Project Analysis

Objective:

The objective of this project analysis aims to analyze company revenue while forecasting the following year revenue goals. The project analyzes historical data on revenue, regional market performance, consumer segments, and product categories to provide insight and recommendation to increase future sales and profits through viable marketing strategies, and insights to better understand customer segments and their buying behaviors to increase consumer engagement.

Context:

Superstore specializes in selling a wide range of technology, office supplies, and furniture products. Stakeholders aim to boost profits by expanding the store’s presence in current regional markets and enhancing customer engagement. To achieve this, an in-depth analysis of revenue performance, regional markets, and customer behavior is needed to develop better pricing and marketing strategies. The company has identified certain regions and product categories with negative profit margins and seeks to address these issues while maximizing overall revenue growth.

Key Questions:

What are the consumer purchasing patterns and buying behaviors based on product categories?

Which regions have yielded to be the highest and lowest performing markets? Which regions based on performance appear to be the primary market base?

Which customer segments contribute to the most profitable and what strategies can help to encourage better customer engagement and buyer loyalty?

When are the peak sales performance and when does the store see its slowest profitable periods?

Project Tools:

Excel

Tableau

Python

Jupyter NoteBook

Anaconda

Pandas

Matplotlib

Seaborn

Project Skills:

Data Sourcing

Data Wrangling

Data Subsetting

Data Filtering

Data Merging

Data Consistency Check

Data Clustering & Aggregation

Deriving New Variables

Data Visualization

Timer-Series Analysis

Project Process

Fist Stage- Cleaning Process

The project began with sourcing my open data for the project. After sourcing the required data, I began the exploratory process of the data check with its cleaning process. In the this process, I began descriptive analysis of the data, filtering and cleaning data columns from duplicates and missing values, and then finding correlations and scatterplots between the numerical factors of what drove revenue.

Second Stage- Aggregating & Clustering Data & Visual Creation Process

After the cleaning process, I begin aggregating and clustering the cleaned data. This was done through the reviewing of the statistical data obtained, segmenting customer data into clusters of regions and buyer behavior. Following the data aggregation and clustering, I began the creation of relevant visualization graphs to accurately represent data findings within the clustered data and the statistical data found.

Conclusion- Key Insights and Recommendation Analysis

Insight Analysis

Revenue Key Insights:

I began my analysis by focusing on revenue, using line charts and scatterplots to visualize trends over time and examine the relationship between sales and profit. This approach highlighted seasonal patterns in sales and allowed me to identify a moderate positive correlation between sales and profit.

The line forecast revealed that sales exhibit a clear upward trend with recurring seasonal peaks, while profits remain relatively stable with a flatter trajectory. Both sales and profit are projected to experience slight growth moving forward, with sales showing more dynamic seasonality compared to the steadier trend observed in profit.

Residual analysis indicated random fluctuations in both sales and profit, suggesting some noise in the data but no significant underlying patterns that would distort the overall trends.

Regional Key Insights:

I focused on the market aspect of the data, utilizing a variety of visualizations—including bar charts, pie charts, treemaps, choropleth maps, and correlation maps—to analyze regional sales and buyer preferences. These tools enabled a clear comparison of performance across regions and customer bases.

The regional analysis revealed that the West consistently generates the highest revenue and profit, while the Central and East regions perform moderately well with lower profit margins. In contrast, the South exhibits the lowest sales and profit performance. Product-specific analysis showed that categories like Machines and Binders excel in the West, while products such as Chairs demonstrate strong sales across multiple regions.

Consumer Segments Key Insights:

In this stage of analysis, I focused on the consumer aspect of the data, using bar charts to compare consumer performance based on product preferences, loyalty, and order behaviors. This visualization approach provided insights into customer purchasing habits and loyalty trends.

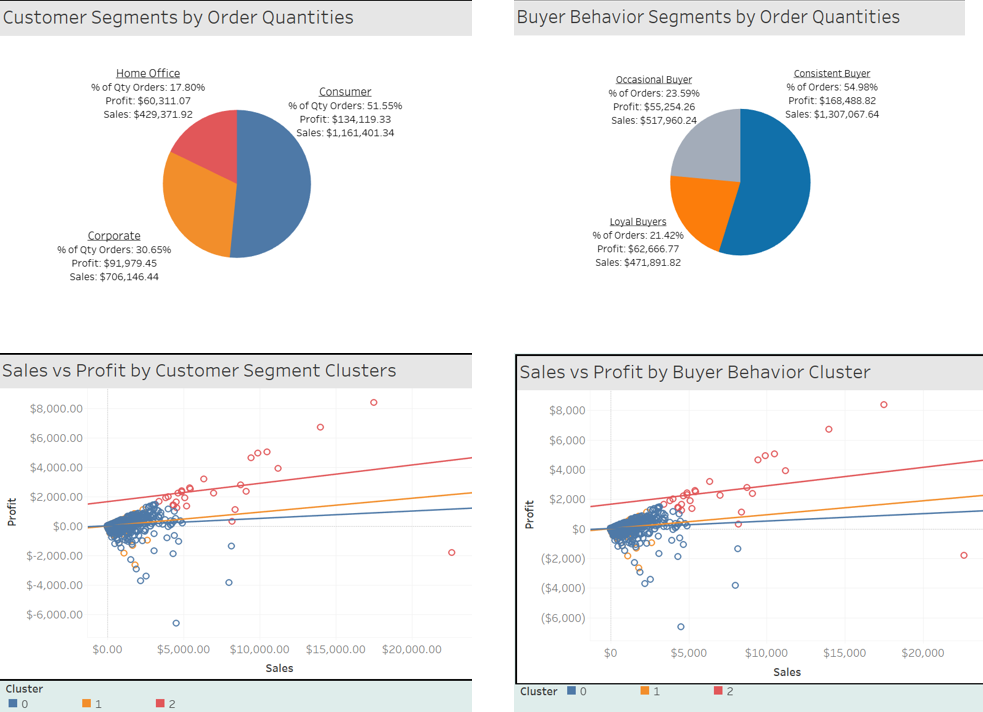

The analysis revealed that the Consumer segment generates the highest sales, contributing over 51% of total order quantity and driving the largest profit. The Corporate segment accounts for approximately 30% of orders and delivers substantial revenue. Additionally, buyer behavior analysis showed that Consistent Buyers dominate with nearly 55% of total orders, leading to the highest sales and profit figures.

Product Key Insights:

In the final stage of analysis, I focused on product performance using bar charts to compare sales and profit at both the category and sub-category levels. This approach allowed me to identify correlations between products and opportunities for bundling poorly performing items with high-performing ones.

The analysis revealed that Office Supplies account for the majority of order quantity, contributing over 60% of total orders. However, Technology generates the highest sales and profit despite representing only 18% of orders. The heatmap further highlighted key product categories like Supplies and Copiers, which demonstrated strong correlations with sales and profit, making them ideal candidates for bundling opportunities. Conversely, categories like Art and Appliances showed weaker correlations, indicating a lower potential for bundling or cross-selling.

Additionally, Technology leads in sales and profit but has lower order placement, with the West region being its most profitable market. Office Supplies perform well across all regions, significantly contributing to order placements, while Furniture struggles with profitability due to high production costs or inefficient pricing strategies, despite decent sales figures. Products like Chairs perform consistently across multiple regions, whereas items like Bookcases and Storage face challenges with negative profit margins.

Recommendations:

Focus promotion and discount strategies around seasonal peak periods to maximize revenue on the high demand.

Introduce cost-cutting strategies in operational efficiency to increase profit in low performing products and regions.

Company should aim to focus customer conversion of its consumer segment into more loyal buyers through engagement focused strategies, such as loyalty program rewards and targeted product promotions.

Aim to build strong relationship with corporate customer segments through B2B marketing strategies to encourage the more frequent placement of larger orders and develop more loyal corporate customer base.

Adjust pricing strategies or consider offering bundles with high-demand products to offset low profitability for poorly performing products like binders, bookcases, and storage.

Create more loyalty programs and exclusive deals for loyal buyers to increase their engagement and order placements to increase revenue from loyal buyers.

For high-performing categories, the company should expand the product lines with new products or services , such as upgrades or add-ons, to help increase profitability of these products and maximize revenue.